On this page...

October 2024

Open Enrollment for 2025 Benefits -

Monday, October 7 through Thursday, November 7, 2024, 6:00 p.m. (CST)

This issue of HRExpress is dedicated solely to this year’s Open Enrollment period. Please read this information carefully. You will also receive an enrollment task in Workday and an announcement on the Workday homepage to help direct your Open Enrollment efforts.

Contact your Human Resources Associate (HRA) with any questions.

Back to top

What You Need to Know

- The Open Enrollment period is your only opportunity to review your current State of Iowa benefit coverage and make changes for 2025 (unless you have a qualified life event in 2025.)

- Health and Dental Enrollment for 2025 - If you do not make any changes to your health and/or dental insurance during this Open Enrollment period, your 2024 options and coverage level (single or family) for health and/or dental will automatically remain the same in 2025. Please note, this is NOT an open dental enrollment for SPOC-covered employees.

- A new dental plan feature (excluding SPOC-covered employees) has been added for 2025. Check-Up Plus will promote preventive care and save on costs over the long term, with diagnostic and preventive services not counting toward your annual benefit maximum.

- Flexible Spending Account Notice - To participate in the Health Flexible Spending Account (FSA) or the Dependent Care FSA, or both, employees must enroll each year. The maximum Health FSA contribution for 2025 is $3,200, and the maximum Dependent Care FSA contribution remains at $5,000.

- Save for Later - Open Enrollment takes place in Workday. If you start the process and decide to take a break, be sure to choose “Save for Later” to save your work. When you do this, you MUST go back and finish your enrollment before the deadline date. Your final enrollment selections will not be processed unless you finish and select the “Review and Sign” section. No enrollments will be accepted after the deadline date.

- Domestic Partners - All employees covering a domestic partner will be contacted by their HRA to complete a new declaration before October 25, 2024. If you need to add a Domestic Partner, please contact your HRA.

- Disabled Dependents - All employees covering a disabled dependent over the age of 26 will be contacted by their HRA to complete a new certification before October 25, 2024. If you need to add a disabled dependent, please contact your HRA.

- Full-time Students - All employees covering a full-time student over the age of 26 will be contacted by their HRA to complete a new certification before October 25, 2024. If you need to add a full-time student, please contact your HRA.

The vision insurance program is administered by World Insurance. Enrollment is NOT done in the Workday system. Open enrollment for vision will take place in January and February of 2025, with elections taking effect on April 1, 2025. Additional information will be shared in December.

Back to top

A Step-By-Step Guide

Work through the links below to guide you through the Open Enrollment process:

Step One: Determine Your Eligibility and Review Benefits

Step Two: Finalize Your Decisions

Step Three: Proceed to Open Enrollment in Workday

Back to top

Step One: Determine Your Eligibility and Review Benefits

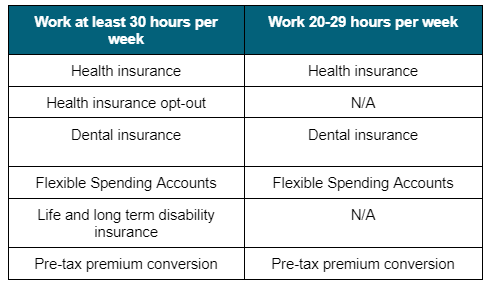

Benefit Eligibility

These are the benefits you can elect during the Open Enrollment period. You are eligible for the following benefits based on the number of hours you work per week.

To determine eligibility for your family members, review the information on the Benefit Eligibility for Family Members web page.

Health Insurance

During the Open Enrollment period (or as a result of a qualified life event), you may enroll in health coverage, change to a family or single plan, or add or remove eligible family members to your health insurance.

All employees (except SPOC-covered) can choose one of these two health insurance options for 2025:

- Iowa Choice: Offers access to a large selection of doctors and hospitals in Iowa and in counties sharing a border with Iowa. Iowa Choice is a Health Maintenance Organization (HMO) plan. Providers who participate belong to the Wellmark Blue HMO network. Benefits for covered services are available only when received from Wellmark Blue HMO network providers. Services received from non-participating providers will not be paid by Wellmark. Visit the Wellmark website to check participating providers in your area. Services received from out-of-network providers may be covered in the case of accidental injuries or emergencies.

- National Choice: Offers access to a large selection of doctors and hospitals in Iowa and nationwide. With National Choice, you may seek health care from any provider located in the United States. While you can see any provider you choose, you will have lower out-of-pocket expenses if you choose a Wellmark Blue Preferred Provider Organization (PPO) network provider.

For SPOC-Covered Employees Only

- Alliance Select: Offers access to a large selection of doctors and hospitals in Iowa and nationwide. With Alliance Select, you may seek health care from any provider located in the United States. While you can see any provider you choose, you will have lower out-of-pocket expenses if you choose a Wellmark Blue PPO network provider.

Health Insurance Summary

To assist you in making an informed decision about the best coverage for you and your family, review your health insurance options outlined on the 2025 Open Enrollment webpage, including:

- A side-by-side summary of the Iowa Choice and National Choice options.

- A summary of the Alliance Select plan (for SPOC-covered employees only.)

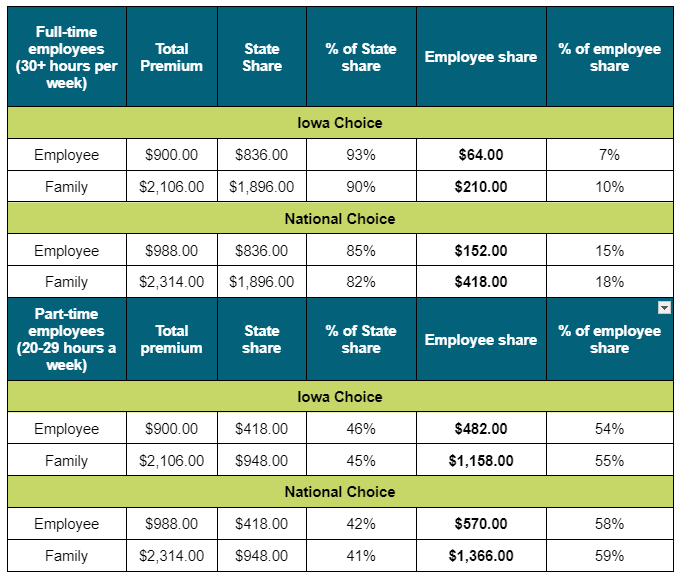

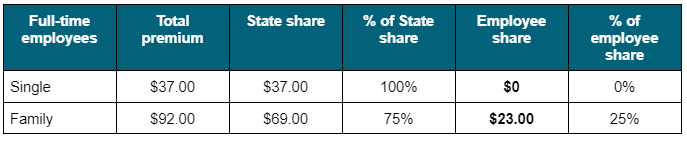

2025 Monthly Iowa Choice and National Choice Premiums

Please note, changes to your health insurance premium deductions will be reflected on the pay warrant issued December 27, 2024.

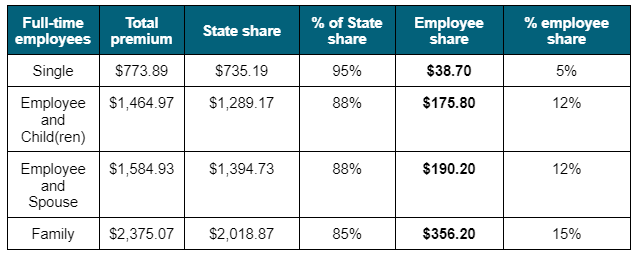

2025 Monthly Alliance Select Premiums (SPOC-covered only)

Health Insurance Opt Out

You may be eligible to opt out of State-sponsored health insurance and receive a payment of $125 monthly if:

- You are a full-time (30 or more hours per week) benefit-eligible employee

AND

- You are NOT covered by an Alliance Select (SPOC-covered), Iowa Choice, or National Choice active or retiree health insurance option through a family member.

If you opted out of health insurance in 2024 and want to continue the option in 2025, the election will roll over into 2025. If you want to opt out beginning in 2025, you will need to do so in the medical insurance section of the open enrollment process in Workday.

The $125 opt-out payment is:

- Paid on the first pay warrant of the month

- Taxed as part of your income as your W-4 requested withholding status

- Shown on the online payroll warrant in the “Other Pay” field

Dental Insurance

During the Open Enrollment period (or as a result of a qualified life event) you may enroll in dental coverage, change to family or single coverage, or add or remove eligible family members to your dental insurance.

Dental Insurance Summary

Summaries of the Delta Dental plans are available on the 2025 Open Enrollment web page.

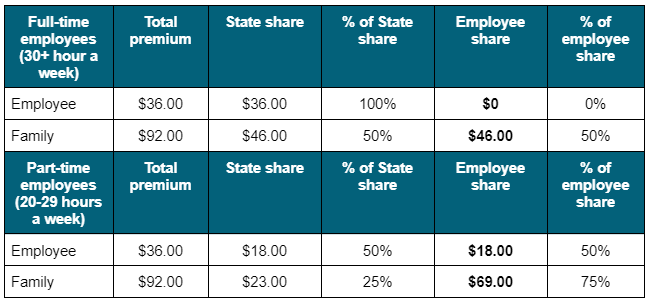

2025 Monthly Dental Premiums for All Employees (Except SPOC-Covered)

2025 Monthly Dental Premiums for SPOC-Covered Employees

Please note, per the SPOC Collective Bargaining Agreement, this is NOT an open dental enrollment for SPOC-covered employees. The 2025 dental insurance premiums will be reflected beginning with the pay warrant issued December 27, 2024.

Flexible Spending Accounts

A Flexible Spending Account (FSA) allows you to set aside money from your paycheck (with no tax withholding) to pay for medical or dependent care expenses. If you wish to make contributions in 2025 to a Health or Dependent Care FSA, you must actively enroll during this Open Enrollment period.

For more information about who is covered under your FSA, please visit the FSA web page.

Here's how the program works:

- You decide how much to set aside annually for health or dependent care expenses, or both. This amount is divided equally by 24 pay periods.

- Through payroll deduction, this amount is taken from your paycheck before taxes and deposited

- into your FSA account(s).

- You incur an expense and choose a claim option to receive reimbursement.

- ASIFlex (the State’s FSA administrator) processes your claim and sends you reimbursement by direct deposit or check. You may elect to have your reimbursements placed directly into your checking or savings account by adding direct deposit information when you log into your account on the ASIFlex website.

- The automatic payment option allows you to be reimbursed for expenses without having to submit claim forms or supporting documentation.

Health FSA

A Health Flexible Spending Account (HFSA) is for eligible medical expenses such as coinsurance, copays, deductibles, over-the-counter (OTC) drugs, and for prescription drugs for health, dental, and vision care for you, your spouse, and your dependents.

With the Health FSA, certain medical expenses for you and your eligible family members can be

reimbursed. Medical expenses eligible for reimbursement include most medically-necessary health care expenses which are not paid through medical or dental insurance plans. Information on commonly claimed expenses is available at the ASIFlex Eligible Expenses website or from ASIFlex customer service at 800-659-3035.

Your share of health and dental insurance premiums are not eligible for reimbursement from the Health FSA since premiums are made with pretax dollars.

Maximum Annual Health FSA Election: The maximum Health FSA contribution is $3,200 in 2025. This limit is per employee, not per household. A State employee’s limit is not lowered if the employee’s spouse also contributes to a health FSA plan, whether the spouse works for the State or elsewhere.

Carryover Amount: Your unused 2025 Health FSA contributions remaining at the end of the year can be carried over to reimburse expenses incurred during calendar year 2026, up to the maximum amount of $640. The carryover will not reduce your 2026 election, but must be used in 2026 or it will be forfeited. Should you leave employment in 2026, your ability to receive reimbursement from carryover dollars ends on the last day of the final month of your employment.

Dependent Care FSA

A Dependent Care Flexible Spending Account (DCFSA) is for expenses of child care for a child under 13 or an adult incapable of self-care so you and your spouse, if any, remain able to work. DCFSA is not for medical expenses for your dependents. Information on commonly claimed expenses is available at the ASIFlex Eligible Expenses website or from ASIFlex customer service at 800-659-3035.

Maximum Annual Dependent Care FSA Elections: The maximum annual Dependent Care FSA contribution is $5,000 per household (up to $2,500 each if you are married and file a separate tax return).

Grace Period: The grace period for the Dependent Care FSA allows you to incur eligible expenses through March 15, 2026. For instance, if your 2025 Dependent Care FSA election is $5,000 and you incur claims totaling $4,400 in 2025, you can incur claims for $600 from January 1, 2026 through March 15, 2026, and be reimbursed from your 2025 Dependent Care FSA.

Your 2025 FSA payroll deductions will be reflected on your payslip issued January 10, 2025.

Life Insurance

The State of Iowa's life insurance plan provides your family financial protection in the event of your death. Each year, you can make changes to your supplemental life insurance coverage during the Open Enrollment period.

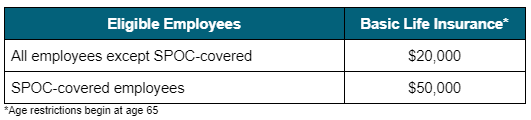

Basic Life Insurance

The State pays 100% of the premium for basic life and accidental death and dismemberment (AD&D) insurance. The amount of basic coverage is:

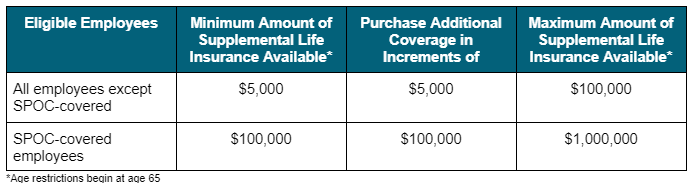

Supplemental Life Insurance

In addition to the basic life insurance coverage, you have an opportunity to elect supplemental term life insurance at group rates. Rates for supplemental life insurance can be found on the 2025 Open Enrollment web page.

Rates for supplemental life insurance can be found on the 2025 Open Enrollment web page. Increases, decreases, or cancellation of supplemental life insurance are made in Workday.

Increasing Your Supplemental Life Insurance: During the Open Enrollment period, you may elect to increase your supplemental life insurance coverage up to the maximum allowed of $100,000 (or $1,000,000 for SPOC-covered employees.) Any increases to your supplemental life coverage must be approved by The Standard Life Insurance Company before becoming effective.

When you make an election to increase your life insurance coverage, you will be prompted to complete the Evidence of Insurability (EOI) online. The EOI for additional supplemental life insurancemust be on file with The Standard within 60 days of the end of Open Enrollment. If the EOI is not on file by Monday, January 6, 2025, your request for additional supplemental life will be denied.

If approved, the increase in supplemental life coverage will be effective January 1, 2025, or the first of the month following notification of approval by The Standard.

Decrease or Cancellation of Your Supplemental Life Insurance: During the Open Enrollment period, you may elect to decrease the amount or cancel your supplemental life insurance. The decrease or cancellation does not require approval and will be effective January 1, 2025.

No Change in Your Supplemental Life Insurance: If you do not want to change the amount of your supplemental life insurance, you do not have to re-elect the amount. Your 2024 election will carry forward into 2025. EOI is not required if you are not making any changes.

Check Your Life Insurance Beneficiaries: The Open Enrollment period is the perfect time to review, add, or change your life insurance beneficiaries, even though life insurance beneficiaries can be added or changed in Workday at any time during the year.

If you have not added or updated your life insurance beneficiaries, don’t delay. Having an up-to-date beneficiary designation will help ensure your life insurance benefits are directed where you intend. There are instructions on the 2025 Open Enrollment web page to assist with updating beneficiaries.

Premium Conversion Plan

The Premium Conversion Plan allows you to pay your share of health, dental, and supplemental life insurance before federal, state, and FICA taxes are calculated. By deducting premiums from your salary on a pretax basis, you save money on your income and FICA taxes.

All employees are enrolled in the Premium Conversion Plan at the time they are hired, unless they opt out during their first 30 days of employment.

If you wish to change your participation in the Premium Conversion Plan for 2025 (elect into or out of this benefit), complete the Premium Conversion (Pretax) Program form and send it to your Human Resources Associate. If you choose to change your participation, you may not make another change until the 2026 Open Enrollment period, unless you have a qualifying life event.

Back to top

Step Two: Finalize Your Decisions

There are many factors to consider when choosing your benefits for 2025. Be sure to read the available materials fully before you make a decision.

Model My Pay - Learn more about Workday’s Model My Pay feature, giving you the opportunity to model hypothetical changes to your pay. This feature is available only for employees with pay details located in Workday, excluding DOT. Accessed through the Pay application on the Workday homepage, Model My Pay allows you to adjust tax elections, deductions, and earnings to view an approximation of how the hypothetical changes will affect your pay. Refer to the Model My Pay Smart Guide to help you finalize your Open Enrollment decisions.

When you know what benefits you would like to elect or change, please move on to Step Three.

Back to top

Step Three: Proceed To Enrollment in Workday

Employees will make their 2025 benefit elections in Workday. These two references are available to assist with the process:

- Open Enrollment Smart Guide - detailed instructions with screenshots

- Mobile Open Enrollment Smart Guide - for use with your mobile devices

DOT employees will also complete Open Enrollment in their Workday tenant. For additional guidance with Open Enrollment, DOT employees should refer to their DOT Job Aid for instructions.

Important reminders:

- If you do not make any changes to your health or dental insurance during this Open Enrollment period, your 2024 option and coverage level for health and dental will automatically remain the same in 2025.

- To participate in the Health Flexible Spending Account (FSA) or the Dependent Care FSA, or both, employees must enroll each year. If you wish to enroll for 2025, refer to the FSA Smart Guide to update your elections in Workday.

- Once you have logged into Workday, open the Open Enrollment announcement and click the blue “Employee Benefits Open Enrollment” selection. Then, click “Let’s Get Started.” Select “Manage” on each of the Benefit Cards to update your benefit elections. Once you have gone through the different benefits and saved those actions, you must choose “Review and Sign” to e-sign by selecting the “I agree” checkbox and clicking submit.

- To take a break in the open enrollment process in Workday, choose “Save for Later” to save your work. When you do this, be sure to go back and finish your enrollment before the deadline date. Your final enrollment selections will not be processed unless you finish the process and select the “Review and Sign” section. No enrollments will be accepted after the deadline date.

Action is needed in Workday during the Open Enrollment period if any of the following apply to your situation:

Health Insurance

- Enroll, change, or cancel your health insurance plan

- Change your coverage level

- Add or remove eligible family members

- Elect the health insurance opt out

- Decline coverage if no health coverage is needed

Dental Insurance

- Enroll in dental insurance

- Cancel your dental insurance

- Change your coverage level

- Add or remove eligible family members

- Decline coverage if no dental coverage is needed

Flexible Spending Accounts

- Enroll in the Health Flexible Spending Account and elect up to a maximum of $3,200 in 2025

- Enroll in the Dependent Care Flexible Spending Account and elect up to $5,000 if married and filing a joint tax return, or $2,500 if married and filing a separate tax return for 2025

Basic and Supplemental Life Insurance

- Enroll in Basic, if not currently enrolled - EOI required

- Increase the amount of supplemental life insurance, up to the maximum amount available

- Submit the EOI for basic or additional supplemental life insurance. It must be on file with The Standard by Monday, January 6, 2025. This only applies if you have made a change.

- Decrease the amount of your supplemental life insurance election

- Cancel your supplemental life insurance

Premium Conversion

- Change whether the premiums for health, dental, and supplemental life insurance are taken pre-tax (before federal, state, and FICA tax) or post-tax (after federal, state, and FICA tax)

Important Dates to Remember

- November 7, 2024, 6:00 p.m. (CST) - The Open Enrollment period for 2025 benefits ends

- December 27, 2024 - Changes to health and dental insurance deductions are reflected on pay warrants

- January 1, 2025 - Benefit elections made during this Open Enrollment period are effective

- January 6, 2025 - The Evidence of Insurability (EOI) for basic and additional supplemental life insurance you elect during the Open Enrollment period must be on file with The Standard

January 10, 2025 - FSA elections will be deducted starting on the pay warrant issued that day

HRExpress is a publication for State of Iowa employees. For prior editions, visit the HRExpress webpage.

If you have questions or suggestions for future content, please contact us at hrexpress@iowa.gov.

10/2/23

Back to top