On this page...

July 2024

Back to topState of Iowa Benefits

Check out Wellmark’s Guest Membership if You or Your Dependents Live Out of State

If you have children or dependents living out of state, or you’re retired and plan to head south for the winter, you’ll be pleased to know about Wellmark’s Guest Membership option available through your Iowa Choice insurance coverage.

Your Wellmark Iowa Choice plan provides a Guest Membership benefit for retirees and active employees’ eligible dependents who reside outside Wellmark’s Blue Access network for 90 consecutive days or more in a plan year. The Guest Membership benefit enables dependents and retirees to access covered services from Blue Cross and Blue Shield participating hospitals, physicians, and other health care providers in the state where the covered dependent or retiree is set up on guest membership. Guest Membership is only available within the United States.

Copays, deductible, and coinsurance remain the same as long as you are seeing a participating provider. To access an out-of-state provider, use the indemnity network on Provider Finder on Wellmark.com.

Learn more and request a Guest Membership by contacting Wellmark’s customer service at 800-622-0043.

Back to top

Education Opportunities

Take a Look at the New PDS Course Catalog

The Fiscal Year 2025 (FY25) Course Catalog has been unveiled and is available on the DAS website to view or print. Exciting changes this year include:

- From Interview to Hire is now Vacancy to Hire! This on-demand course is for all hiring managers and anyone participating in the hiring process. It will still be part of our Leadership Capacity Building Development (LCBD) Certificate Series.

- Thriving on Change is no longer being offered and has been replaced by The Power of Habit in the Advanced Talent Development (ATD) Certificate Series. If you are interested in change-related training, you might check out Leading Through Change.

Welcome to Workday Learning

Workday Learning is now live! Log into your Workday account and check out the Workday Learning eLearning course to get started. Workday Learning is a great tool, allowing you to browse the online PDS catalog and enroll in upcoming courses with ease. Please reach out to your agency’s Learning Admin with any questions.

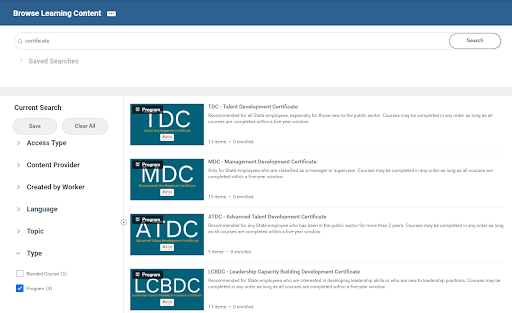

Sign up for a Certificate Series Program Today!

There’s a new way to enroll and complete the PDS certificate series offerings. If you are interested in starting a certificate series, simply search for the series in the Workday Learning catalog and enroll!

Please note: if you are in the middle of a series, please continue to use the tracking forms found on the DAS website until you complete your current certificate.

Quick Links

- Check out PDS website for course offerings

- Enroll through the LMS - OKTA | external

- Find your PDS Partner

Contact us with any questions!

Back to top

Health and Well-Being

Trade Workplace Stress for Success: 4 Myth-Busting Facts

We all experience stress from time to time, but what happens when it starts to overwhelm you and affect the quality of your work? Wellmark Blue Cross and Blue Shield of Iowa helps dispel four common work stress myths in Trade Workplace Stress for Success: 4 Myth-Busting Facts. This quick read is filled with great information and resources to increase your well-being at work and at home.

Enjoy a Healthful and Fun Picnic This Summer!

There are few things more relaxing and enjoyable than a summer picnic. No matter the style or size of your gathering, it’s easier than you think to assure your outdoor dining experience is safe, healthy, and fun for everyone.

A healthy picnic combines activities that help bring people together, such as good food, games, and great conversation. Livongo by Teladoc Health and Wellmark have teamed up to provide you with helpful tips to make your summer picnic both healthy and memorable. Take a moment to read Healthy Picnic - Let’s Go and begin planning your next picnic adventure today!

Free Health and Well-Being Seminars Offered Online

On-demand online seminars covering various health and well-being topics are available from Acentra, the State’s Employee Assistance Program (EAP) provider, at www.EAPHelplink.com. Use Company Code: IOWA and click on e-learning for a list of available online seminars.

Seminars are free of charge, with the most current offerings available on the dates listed below.

- Available now: Living Well 365: Igniting Motivation for a Fulfilling Life - Examine strategies for self-care to improve physical health, nurture mental well-being, foster positive relationships, and adopt healthy habits.

- Available July 16: Parenting Adolescents: Understanding Gen Z - This training will equip parents and caregivers with practical strategies to navigate the unique challenges and opportunities that present themselves with teenage children.

EAP also offers confidential resources at no cost to help employees and eligible family members address many of life’s challenges. For more information on EAP resources, visit the DAS Employee Assistance Program web page.

Back to top

Work Smart with Workday

Workday Changes for Meal Per Diem

Effective July 5, 2024, employees will no longer be required to submit receipts for meal expenses. Instead, a meal per diem rate will apply for all employee travel. The procedures for determining the meal per diem amounts are listed in the SAE Policy and Procedure Manual.

For travel on or after July 5, the following changes to Workday processing will go into effect:

- Spend Authorizations

- Departure Time and Arrival Time for Meal Lines will no longer be required.

- Expense Reports

- Departure Time and Arrival Time for Meal Lines will no longer be required.

- Actual Receipt Amount for Meal Lines will no longer be required.

- Attachments for Meal Lines will no longer be required.

- Although not needed for current and future use, all fields will remain on Workday at this time to ensure processing for travel prior to July 5 can continue.

For additional information on the per diem change, please review the SAE Policy and Procedure Manual or contact Anieta.OHair@iowa.gov.

Need Workday Support?

Finding help is easy if you follow these three steps:

- Check the resources. Check out these step-by-step how-to guides, located in the Training Catalog on the WorkSmart website.

- Ask a friend. If you know other employees who have the same job responsibilities, ask if they have a solution for you. This is often the easiest and fastest way to address your questions.

- Submit a ticket. If you still need help, submit a service ticket to get your questions answered.

Back to top

Retirement Benefits and Savings

IPERS Offers Ready, Set, Retire Workshop in Zoom

Retiring in the next three to five years? If so, IPERS offers you Ready, Set, Retire, a free all-day Zoom webinar just for you! You may view/attend sessions during work time if scheduling permits and your supervisor approves. Spouses are welcome to attend. View the description and upcoming workshop dates and reserve your spot by clicking on the workshop you wish to attend and then click “Register.”

News from the RIC Team

Across-the-board (ATB) salary increases can help pump up your RIC account!

ATB salary increases offer an amazing, if not painless, way to increase your retirement savings over time. These small savings increases add up over time and can make a huge difference to your RIC 457 value down the road.

You can increase the amount you are currently investing in your RIC 457 by as much or as little as you wish, although retirement experts suggest pumping up your contribution rate by 1 to 2% of your salary each year if possible.

Use this handy compound interest calculator to estimate the future value of your savings efforts. You can invest the increase and watch it grow so it is there when you’ll need it most.

SageView invites you to register for an upcoming live financial webinar

Join SageView’s Retirement Readiness Workshop on any of the following dates:

- July 24 - 1:00 p.m.

- August 21 - 1:00 p.m.

- September 18 - 1:00 p.m.

During this one-hour workshop, SageView will cover:

- Taxes in retirement - strategies for drawing down assets in retirement

- Healthcare in retirement - Medicare options and long-term care

- Your Financial Legacy - preparing for the unexpected with trusts, wills, and estate planning

RIC webinars available monthly

- RIC Introduction & Enrollment - Learn the benefits of participating in the Retirement Investors’ Club (RIC), the state’s supplemental retirement savings plan. Discuss reasons to save, the employer match of up to $75/month, options for investments, tax advantages, and enrollment. Register to attend.

- RIC Retiring Soon - Employees who are five years or less from retirement will learn about options for deferring final pay, making Roth and/or pre tax contributions and taking income after leaving employment. Discussion will also include information on whether rolling your funds into an IRA is the right move for you. Register to attend

News from Your RIC Providers

Don’t you, forget about me . . .

It’s time to help the often-overlooked MTV generation (Gen X) get successfully to and through retirement. Sixty five million strong and quickly marching toward retirement, Gen X is a generation that should not be overlooked, discounted, or forgotten. Read Gen X Retirement Insights to learn more!

Upcoming Corebridge Webinars

- July 11 – IPERS and Deferred Compensation - 9:00-10:00 a.m. (RIC co-sponsored webinar, authorized during work hours)

- July 11 – IPERS and Deferred Compensation - 2:00-3:00 p.m. (RIC co-sponsored webinar, authorized during work hours)

The following webinars are held at: 11:30 a.m. | 12:30 p.m. | 4:00 p.m. | 7:00 p.m. | Register Here

- July 16 – Managing Life in Retirement – Obstacles to Overcome

- August 6 - Social Security and Your Retirement – What You Need to Know About Social Security

- August 20 - How Medicare Parts and Prices Fit In To Retirement

Can’t schedule in the webinars? Watch them on-demand here.

Consolidating can help you keep it simple

If you’ve had jobs with multiple employers, you may still have retirement accounts from those jobs. Those accounts are an important part of your financial picture and play a key role in helping you build up the income you’ll rely on in retirement. But are you actively managing those accounts?

By rolling the assets from those accounts into your current Empower account, you can make sure you’re engaged with all your retirement assets.* You’ll also eliminate the complexity of dealing with multiple statements, multiple usernames and passwords, and multiple contact centers. Other benefits include:

- The potential for lower fees – Empower works to keep fees low and competitive.

- A consolidated view of all your retirement assets – Consolidating accounts gives you similar visibility across all your retirement-related assets.

- A single point of management – When it comes time to adjust your investment strategy to align with your changing finances, you’ll only have one account to update.

Consolidating your outside retirement accounts into a single qualified retirement plan may save you time and make it easier for you to achieve the future you want.

For more information, including which accounts you can consolidate, how to roll outside assets into your plan, call 888-737-4480 to speak with a financial professional weekday from 7 a.m. to 7 p.m. CT. Learn more about Empower - Visit empower.com/iowaric.

*Funds rolled into a governmental 457 plan from another type of plan or account may be subject to the 10% early withdrawal penalty if taken before age 59½.

Take control of your future with help from a retirement readiness check-up!

Did you know many adults may not be financially prepared to retire when they want? Think about this:

- How much income will you need? Check out our retirement income calculator to find out!

- Will you have a shortfall?

- How do you plan to combat inflation?

- Will you take money from your savings to support your basic needs in retirement?

- What type of financial legacy do you want to leave?

Now is the time to put a strategy into place so you don’t outlive your income. Contact your Horace Mann Representative today for help with your retirement readiness checkup.

Find out more about how your retirement income will impact your dreams by attending Horace Mann’s webinar, Retirement Income Distribution (Nearing or at Retirement). Register with Horace Mann here.

How are you invested in your Iowa Retirement Investors' Club (RIC) Retirement accounts? Investing in a mix of asset classes may help keep your retirement portfolio in shape.

Many experts recommend spreading your retirement savings into a variety of investment funds to help manage the rise and fall of the value of your account. If one of your investment funds is not performing well, others might be performing better.

If you are invested in a single fund (other than a balanced or target date fund), you are encouraged to review your strategy. Ensure it is appropriate based on your age, investment time horizon, and risk tolerance level.

Login to iowa.beready2retire.com or contact your Voya advisor to review your investments today.

HRExpress is a publication for State of Iowa employees. For prior editions, visit the HRExpress webpage.

If you have questions or suggestions for future content, please contact us at hrexpress@iowa.gov.

7/2/24

Back to top