On this page...

December 2024

Back to topState of Iowa Benefits

Flexible Spending Accounts for 2025

If you enrolled in the Flexible Spending Account (FSA) program for 2025, you should have received your enrollment confirmation from ASIFlex. Please review your confirmation carefully for accuracy.

If you are new to the FSA program, you may log into your account on the ASIFlex website and add your bank account information at any time. You may also contact ASIFlex by phone at 800-659-3035 if you have questions about your account or the program.

Additional FSA claim information is available on the DAS website.

Did You Apply for Supplemental Life Insurance for 2025?

If you added or requested an increase in your supplemental life insurance for 2025, the last date to submit Evidence of Insurability (EOI) is on Monday, January 6, 2025. If EOI has not been completed by the deadline date, your request will be cancelled. If you already have coverage in place, the amount will default to your 2024 coverage amount. You may complete the EOI process on the Standard website.

Health Insurance Benefits That Save You Money

Saving money on health care is always a good thing. Take a few moments to read Wellmark’s Health Insurance Benefits that Save You Money - Cut Your Health Care Costs, which outlines four top ways to reduce costs while making the most of your health insurance benefits.

Back to top

Education Opportunities

View Your Upcoming Scheduled Learning

Want a quick look at the scheduled learning you have coming up? Try the new My Learning Schedule report in Workday Learning to view your upcoming live classes! Enter “My Learning Schedule” in the Global Navigation search bar.

Plan Ahead for the Holidays

The busy holiday season is here. Keep your drive for learning and development alive by registering for 2025 courses now! Select the following courses to view details and enroll.

- Diversity Training for Employees (virtual) | January 7

- DAS Safety | Fall Protection (in person) | January 7-9

- Developing Employees (virtual) | January 14

- Enhancing Team Membership (virtual) | January 15

- DAS Safety | Machine Guarding (in person) | January 21

- Dimensions of Behavior (virtual ) | January 22

- The Power of Habit (virtual) | January 28-30

Join CPM Cohort 43

Applications are still being accepted for the Certified Public Managers (CPM) Cohort 43 starting in January. Learn more about the CPM program and application procedures on the PDS website.

Quick Links

- Check out PDS website for course offerings

- Enroll through the LMS - OKTA | external

- Find your PDS Partner

- Contact us with any questions!

Back to top

Health and Well-Being

Time is Your Most Precious Resource

We all have the same number of hours in a day to work with, but is it possible to make the passing time count more? You’ll want to read Time is Your Most Precious Resource, a short article provided by the experts at Livongo and Wellmark, filled with tips to live more mindfully. Using these guidelines over time, you will be able to let go and focus on the moment, bringing more joy and appreciation into your life.

“Healthy” Food and Drinks That Could Harm Your Oral Health

We hear a lot about “healthy” foods and drinks in advertising, on social media, and amongst our friends. But are we really getting accurate information, and what can we do to assure we don’t unknowingly fall into some unhealthy habits? Delta Dental clarifies some of the confusion with Five “Healthy” Food and Drinks That Could Harm Your Oral Health.

Free Health and Well-Being Seminars Offered Online

On-demand online seminars covering various health and well-being topics are available from Acentra, the State’s Employee Assistance Program (EAP) provider, at www.EAPHelplink.com. Use Company Code: IOWA and click on e-learning for a list of available online seminars.

Seminars are free of charge, with the most current offerings available on the dates listed below.

- Available now: Laughter Helps - Discover how a good laugh can boost your mood, strengthen your relationships, and unlock a wealth of other benefits.

- Available December 17: Tools for Life - Take inventory of the different tools in your figurative toolbox, assess your strengths, and learn how to approach life with a new perspective.

EAP also offers confidential resources at no cost to help employees and eligible family members address many of life’s challenges. For more information on EAP resources, visit the DAS Employee Assistance Program web page.

Back to top

Work Smart with Workday

Elect Electronic W-2s for Tax Year 2024!

As a final reminder, encourage your employees to elect to receive electronic W-2 forms in Workday instead of receiving them by mail. Electronic W-2s have several benefits, including earlier access to the document, convenient access and storage, and enhanced security of your personal information.

To ensure their electronic W-2 election is recorded before W-2 forms are printed and mailed, preferences need to be updated by January 1, 2025. Once selected, paper W-2s will not be mailed unless consent is revoked in a future tax year. All terminated employees will receive a W-2 in the mail even if they had opted into electronic only.

Refer to the W-2 Smart Guide for more detailed instructions.

Check Your Address in Workday

In preparation for the end of 2024, be sure to validate your home address in Workday. W-2s and 1095s will be mailed to the address of record in Workday, so it is important the correct address is listed. Please review the Contact Change Smart Guide for steps to update your address in Workday.

Need Workday Support?

Just follow these three easy steps:

- Check the resources. Check out step-by-step how-to guides, presentations, and video training sessions located in the Workday Learning Catalog. Not sure how to search, check out this Global Search feature clip to learn more.

- Ask a friend. If you know other employees who have the same job responsibilities, ask if they have a solution for you. This is often the easiest and fastest way to address your questions.

- Submit a ticket. If you still need help, submit a service ticket to get your questions answered.

Back to top

Retirement Benefits and Savings

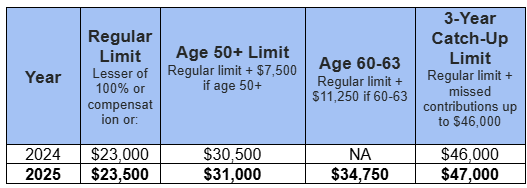

IRS Raises 457 Contribution Limits for 2025

The Internal Revenue Service (IRS) has raised the 457 limits for 2025. In addition, they have added a new limit for anyone turning age 60 through 63 in 2025.

To change your RIC contributions, please make your elections in Workday.

IPERS Offers Ready, Set, Retire Zoom Workshop

Retiring in the next three to five years? If so, IPERS offers you Ready, Set, Retire, a free all-day Zoom webinar just for you! You may view/attend sessions during work time if scheduling permits and your supervisor approves. Spouses are also welcome to attend. View the description and upcoming workshop dates and reserve your spot by clicking on the workshop you wish to attend and then click “Register.”

From the RIC Team

The new year offers a fresh sense of hope and opportunity. It is the perfect time to reflect on your goals and aspirations for the future. One of the most significant milestones in life is retirement, when you plan for more relaxation, exploration, and pursuing passions long set aside. Achieving a secure and fulfilling retirement, however, requires thoughtful planning and preparation. No matter where you are in your journey toward retirement, let 2025 be the year you take charge of your retirement dreams!

Log into your RIC accounts to review:

- Account balances and current savings rate – will this be enough for your future? You can use provider tools to help decide how much you should be saving.

- The funds you are investing in – are you comfortable with the amount of risk you are taking?

- Are your beneficiaries and home address accurate?

Want some help? Contact your RIC advisor and request a meeting (free of charge) to make sure you are on track to meet your financial goals. Not sure who your advisor is?

- Call your provider

- Log into your account and locate advisor information

- Look at your most recent statement

- Review advisor listings

Financial Webinars for December

Join a webinar and learn more about a variety of topics. December webinars include:

- Corebridge

Take control of your money in 2025! Discover the importance of starting to save right now, and learn how to save as much as possible while still meeting your other financial goals.

Register to attend Your Future Starts Now (one-hour workshop)

December 3, 2024

Webinars will be held at: 11:30 a.m. | 12:30 p.m. | 4:00 p.m. | 7:00 p.m.

If you can’t attend in person, it is also offered on demand.

- SageView

Learn more about:

– College Savings 529 Plans: Understanding the tax and other benefits

– HSAs and FSAs: Tax-advantaged savings for your healthcare needs

– Roth vs. Traditional 401(k)/403(b): What’s similar, what’s different, what’s right for you?

Register to attend Financial Fitness Workshop (one-hour workshop)

December 11, 2024, at 1:00 p.m.

- VOYA

Prepare for the end of the year and get your finances in order for 2025. Explore five tips to handle your year-end finances and get your finances in order for 2025.

Register to attend Managing your Finances in All Seasons (30-minute workshop)

The webinar will be held at the following times:

December 10, 2024, 9:00 a.m. | 1:00 p.m.

December 17, 2024, 11:00 a.m. | 1:00 p.m.

News from Your RIC Providers

Managing debt to your advantage

While most people would be thrilled to live a life without debt, borrowing money isn’t always bad. It can open up opportunities like a college education or make it possible to afford larger purchases such as a new home or car. It can even make for a nice night out or a wonderful weekend away. With that in mind, this article takes a closer look at the different types of debt, the basics of debt management, and strategies for making sure debt is a help not a hindrance. During periods of market volatility, it’s important to remain calm and focus on your long-term goals. Five key principles can help you keep your emotions in check and stay the course. Read Managing debt to your advantage to learn more!

2025 contribution limits

Contributing as much as you can to your Iowa Retirement Investors’ Club (RIC) account at Empower is a great way to help build up the income you’ll rely on after leaving the workplace. But, keep in mind that the IRS sets annual limits on the amount you can contribute:

- In 2025, the annual contribution limit has increased to $23,500.

- Age 50+ catch-up – If you’re age 50 or older, you can contribute an additional $7,500 in catch-up contributions in 2025. Beginning in 2026, employees who made over $145,000 in FICA compensation the prior year must make any 50+ catch-up contributions as Roth (after-tax) contributions.

- SECURE 2.0 age 60-63 catch-up – Under this new provision, which is effective for the 2025 tax year and thereafter, those aged 60 to 63 can contribute up to $34,750 in 2025.

Please note that you may only use one catch-up provision per year. Contact Empower at 1-833-999-IOWA (1-833-999-4692 with questions on annual contribution limits or catch-up contributions.

If you have questions on these issues and how to make a smooth transition to retirement, schedule some time with your local retirement plan advisor.

Happy holidays from Horace Mann

We’re grateful for our clients, colleagues, family, and friends this holiday season (and all year long).

Be prepared for the journey to and through retirement

Whether your retirement is in the near or distant future, achieving your goals for a dream retirement depends largely on the plans and decisions you make now. Here are a few tips to help you plan any phase of your life:

Saving for Retirement - Your 20, 30s and 40s.

- Start saving for retirement through IRAs and employer sponsored plans, making sure to contribute to take advantage of any employer match

- Set savings goals so you can retire when you want

- Build an emergency fund to cover at least 3-6 months expenses

Nearing Retirement – Your 50s and 60s

- Take inventory of your assets and income needs

- Estimate potential sources of retirement income

- Take advantage of catch-up contributions

At and Through Retirement

- Consolidate retirement plans

- Review your estate plan

- Maintain an emergency fund that covers 12 months’ expenses

Check out our retirement calculators online and contact your Horace Mann representative to schedule an annual review to help you stay on track for the retirement of your dreams.

Prepare to Thrive in 2025

Every year, the IRS announces the latest contribution limits for retirement savings accounts. Certain limits for 2025 have increased, giving you the opportunity to save even more today to help achieve your future goals.

How much do you want to save in the coming year? Visit voya.com/irslimits for the latest contribution limits for all types of accounts in 2025. And if you’re eligible, the catch-up contribution options can help you maximize the saving potential of your remaining working years to reach your retirement goals.

Visit VOYA - Nearing Retirement Series: Checking your progress to learn more about each of these steps. For help using myOrangeMoney or factoring Social Security and Medicare into your future retirement income projection, schedule an appointment with your local Voya representative by calling our Des Moines Office toll-free at (800) 555-1970 or (515) 698-7973, Mondays through Friday, 8:30 a.m. – 5:30 p.m. (CT)

HRExpress is a publication for State of Iowa employees. For prior editions, visit the HRExpress webpage. If you have questions or suggestions for future content, please contact us at hrexpress@iowa.gov.

Back to top