On this page...

August 2024

Back to topState of Iowa Benefits

Save Money With a Health Flexible Spending Account (FSA)

How much do you think you’ll spend on healthcare expenses such as dental care/braces, medical co-pays, vision needs, and prescriptions in 2025? It’s time to crunch some numbers and consider participating in a health flexible spending account for 2025! On average, FSA participants save 30% by paying for eligible healthcare expenses through their health FSA.

During Open Enrollment this fall, you may choose to have up to $3,050 set aside on a pretax basis to pay for 2025 eligible healthcare expenses for you, your spouse, and dependents with the State of Iowa Health FSA benefit. You must re-enroll each year you wish to participate.

To enroll in 2025 Health FSA this fall, you will be asked to enter the total amount you would like to contribute to your Health FSA account for the year. Estimating your expenses ahead of time will help you enter an appropriate amount.

Take time now to estimate the healthcare expenses you may incur in 2025. Visiting with your doctor, dentist, or other healthcare professional may help you understand your financial responsibility for anticipated services or treatments.

Back to top

Education Opportunities

Workday Learning is Live!

Explore hundreds of learning opportunities in our new learning management experience, Workday Learning. Workday Learning is easy to search, with options categorized by department, role, or topic. By staying current with skills, improving work performance, and pursuing personal development, you can make the most of your career with the State of Iowa. Take a look at the Workday Learning for Employees Program to explore all the possibilities! Please reach out to your agency's Learning Admin with any questions.

Note: The Judicial and Legislative branches are currently not using Workday Learning. Please reach out to your HR Business Partner with questions. DOT is currently using their own Workday tenant.

Check Out Learning Highlights

Check out the Highlights section of your learning home in Workday Learning. This section is regularly updated with featured upcoming PDS courses. See something that interests you? Select the course to view more details and enroll.

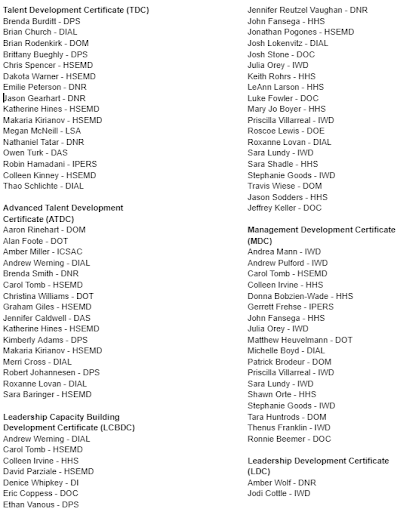

Congratulations PDS Certificate Earners!

Quick Links

- Check out PDS website for course offerings

- Enroll through the LMS - OKTA | external

- Find your PDS Partner

- Contact us with any questions!

Back to top

Health and Well-Being

Back-to-Basics Wellness Tips That Actually Improve Your Health

Products that promote health and wellness are everywhere these days, and many of them are very expensive. You don’t need to spend a bundle, though. There are some simple trends and practices that actually work and won’t break the bank. Read Wellmark’s Back-to-Basics Wellness Tips That Actually Improve Your Health for six low-cost, back-to-basics tips you can try today.

Conquering the Dental Chair

Do you avoid making that all-important appointment for a dental visit? You are not alone. But, avoiding your recommended twice-yearly visits isn’t a good idea. Neglecting dental care can lead to much more significant problems down the road. Read Delta Dental’s Conquering the Dental Chair: How to Overcome Common Barriers to Care to help you tackle some of the most common barriers to getting good dental care.

Free Health and Well-Being Seminars Offered Online

On-demand online seminars covering various health and well-being topics are available from Acentra, the State’s Employee Assistance Program (EAP) provider, at www.EAPHelplink.com. Use Company Code: IOWA and click on e-learning for a list of available online seminars.

Seminars are free of charge, with the most current offerings available on the dates listed below.

- Available now: Parenting Adolescents: Understanding Gen Z - Learn practical strategies to navigate the unique challenges and opportunities that present themselves with teenage children.

- Available August 20: Harnessing Positive Reinforcement for Success - Discover how recognition can inspire, reinforce desired behaviors, and strengthen bonds in your personal and professional spheres.

EAP also offers confidential resources at no cost to help employees and eligible family members address many of life’s challenges. For more information on EAP resources, visit the DAS Employee Assistance Program web page.

Back to top

Work Smart with Workday

WorkSmart Resources Now in Workday Learning!

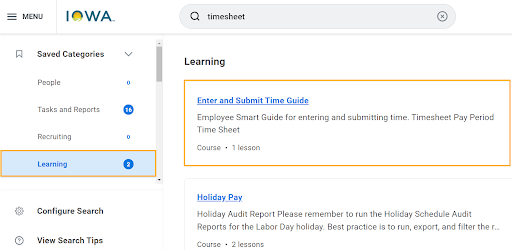

WorkSmart resources have now moved to Workday Learning and the WorkSmart website has been discontinued. To access Job Aids, Smart Guides, and previous A La Carte and HRA quarterly recordings, log into Workday and enter the keyword you are looking for into the Global Search bar. For example, if you enter “timesheet,” you will be able to use the categories to further narrow your search to the Learning resources with that subject matter.

If you don't see Learning in your Saved Categories, select Configure Search and move it up. For more detailed instructions, view this video about using the Global Search feature.

Need Workday Support?

Just follow these three easy steps:

- Check the resources. Check out step-by-step how-to guides, presentations, and video training sessions located in the Workday Learning Catalog for HR staff.

- Ask a friend. If you know other employees who have the same job responsibilities, ask if they have a solution for you. This is often the easiest and fastest way to address your questions.

- Submit a ticket. If you still need help, submit a service ticket to get your questions answered.

Back to top

Retirement Benefits and Savings

IPERS Offers Ready, Set, Retire Workshop in Zoom

Retiring in the next three to five years? If so, IPERS offers you Ready, Set, Retire, a free all-day Zoom webinar just for you! You may view/attend sessions during work time if scheduling permits and your supervisor approves. Spouses are welcome to attend. View the description and upcoming workshop dates and reserve your spot by clicking on the workshop you wish to attend and then click “Register.”

News from the RIC Team

It’s your RIC money – register your RIC account to find out more

Each RIC provider has customized websites specific to RIC participants. Account activity, statements, investment and savings education, financial planning tools, calculators and more are available to you when you register to view your accounts online.

Once you log in, take the time to check your beneficiaries, address, statement delivery method (mail or electronic) and use your provider’s retirement planning tools.

First-time users go to the following links to log in to your accounts.

SageView invites you to register for an upcoming live financial webinar.

SageView’s Retirement Readiness Workshop – Register to attend.

- August 21 at 1:00 p.m.

- September 18 at 1:00 p.m.

During this one-hour workshop, SageView will cover:

- Taxes in Retirement - strategies for drawing down assets in retirement

- Healthcare in Retirement - Medicare options and long-term care

- Your Financial Legacy - preparing for the unexpected with trusts, wills, and estate planning

News from Your RIC Providers

When is the right time to take Social Security?

Every person eligible for Social Security has an important question to answer – when should I start taking payments? Have you thought about what you will do when that time comes? Read When is the Right Time to Take Social Security for more information.

Attend a webinar to learn more: 11:30 a.m. | 12:30 p.m. | 4:00 p.m. | 7:00 p.m.

- August 6 – Social Security and Your Retirement - A secure, comfortable retirement is every worker's dream. Achieving this dream requires careful financial planning to anticipate your income and needs in retirement.

- August 20 – How Medicare Parts and Prices Fit into Retirement - Teaches about the different types of Medicare health insurance and how much each could cost in retirement.

- September 3 – Retirement Pathfinder: Are You on Track? - Retirement Pathfinder from Corebridge Financial is an interactive retirement income planning tool that can help you see your retirement plan like you've never seen it before.

Register to attend at any of the times listed above. Can’t make the webinar? Watch them on-demand.

Cybersecurity and retirement readiness

Scroll through the news, and sooner or later you’ll come across a story about cybercrime or some sort of online security breach. Don’t be a passive victim. Take steps today to protect your sensitive Empower information. Here are a few recommendations:

- Register your accounts – Registering your accounts can reduce the chance someone else will try to gain access to them. If you haven’t yet registered, go to your Iowa RIC with Empower plan website at empower.com/iowaric and click Register.

- Add a personal email address to your account – Update your current contact information on file at empower.com/iowaric. Click on your initials in the top right corner; under Profile and settings click Edit and update personal information. Add a personal email address so you can be contacted more quickly if there are unauthorized changes or transactions.

Follow safe online practices – Creating complex passwords, keeping your antivirus and system software up to date, and regularly logging in to check your account can help keep your account safe. When you follow current and prudent online and mobile security practices, Empower will restore losses to your accounts that occur as a result of unauthorized transactions through no fault of your own.

What do the dog days of summer and saving for retirement have in common?

The dog days of summer can make for a difficult season. Don’t let your retirement be the same way.

Did you know only 68% of Americans are confident in their ability to have enough retirement money?1 You can increase your confidence by enrolling in the Iowa RIC with Horace Mann Retirement Advantage®.

Enroll now and make your payroll deduction elections in Workday. Not sure how much you can or should contribute? Check out our retirement calculators to help you decide what is best for you.

Let Horace Mann help you enjoy your retirement season.

(1 Employee Benefit Research Institute, “2024 Retirement Confidence Survey.”)

Six steps to save for an emergency

Can you cover a $1,000 emergency without using a credit card or making a withdrawal from your retirement savings? When faced with an unexpected need, having an emergency fund can help give you financial confidence and control over your finances.

Saving even $10 a week consistently can add up over a longer time period. You may also benefit from compounding interest, meaning any earnings stay in your account and can generate its own earnings over time.

Here are some ways to get started:

- Set a goal of saving $1,000.

- Set up automatic deposits into your savings account. Start by saving whatever you can afford.

- If your bank allows, create separate accounts to save for emergencies and other financial goals.

- Be sure you can access the money in your emergency savings account, if needed.

- Review the amounts of health and home insurance you have to protect your income and savings.

- Gradually increase your savings over time. Once you reach the $1,000 goal, increase the target until you have saved three to six months of income.

Visit Voya for more tips on how to save for the unexpected now and in the future.

This material has been provided for educational purposes only. It was created to provide accurate and reliable information on the subjects covered. It is not intended to provide specific legal, tax or other professional advice.

HRExpress is a publication for State of Iowa employees. For prior editions, visit the HRExpress webpage. If you have questions or suggestions for future content, please contact us at hrexpress@iowa.gov.

8/6/24

Back to top