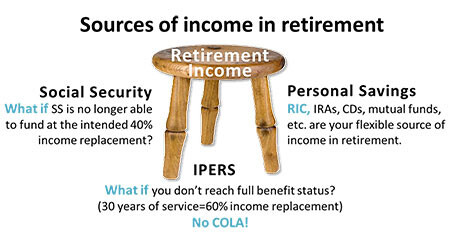

The Retirement Investors' Club (RIC) is the State's voluntary retirement savings program that allows you (if eligible) to set aside a portion of your wages, through automatic payroll deductions. We also enjoy an employer match benefit of up to $75 monthly. RIC plans are designed to help supplement your IPERS pension and Social Security income benefits in retirement. You choose how much to save monthly up to the IRS annual limits).

Deductions are deposited into your selection of RIC investments in a 457 employee contribution account. You may choose to have deductions taken from your paycheck before state and federal income taxes (pretax) or after taxes have been withheld (post-tax Roth) or a combination of both.

Pretax employer matching contributions are deposited into your selection of RIC investments in your 401(a) employer match account (Legislators excluded). There are no vesting requirements for either account.

How your RIC accounts work

Roth Contributions

Payroll deductions are taken after state and federal tax withholding. There is no immediate tax benefit.

Pretax contributions

Payroll deductions are taken before state and federal tax withholding. This lowers your taxable income for the year.

Employer match contributions

Match contributions are deposited to your 401a pretax. The match benefit applies to pretax or Roth 457 contributions.

Eligibility

You are eligible to contribute if you are a permanent or probationary employee of the State of Iowa working 20+ hours per week or an employee who has a fixed annual salary. This program is not offered to Board of Regents Institution employees.

Additional Education

If you would like additional education on the basic features and benefits of the RIC program, you may:

- Register to attend a live online RIC Basics presentation free of charge here.

- Review a recorded webcast

- Contact RIC or the investment providers at anytime